Fitness on a Budget: How Staying Active Can Save You Money

by Kashvi Mahesh

When it comes to managing personal finances, most people focus on cutting recurring expenses or increasing income. However, one of the most impactful (and often overlooked) money-savers is regular physical activity. Not only does exercise improve your health and longevity, but it can also save you a surprising amount of money each year.

1. Slashing Healthcare Costs

Healthcare expenses are a major drain on household budgets, but staying active can significantly reduce these costs:

Annual savings of $500–$2,500: A study in the Journal of the American Heart Association found that people who exercise regularly save between $500 and $2,500 annually in medical expenses, and those with cardiovascular disease see the higher end of savings.

Reduced medication and hospital visits: Individuals with heart disease or risk factors saved about $2,500 per year, while healthier individuals with fewer risk factors still saved around $500.

Long-term financial benefits: One study found that even people who started exercising later in life saved $824–$1,874 per year in medical costs.

In short, consistent physical activity is more than just a health boost—it’s a smart financial move.

2. Boosting Productivity and Reducing Absenteeism

Being healthy isn’t just financially beneficial in terms of direct medical costs, it also pays off in productivity:

Less time off work: Moderately active adults incur $1,200–$1,600 less in annual medical expenses than inactive peers, partly due to fewer sick days.

Economic value per step: Walking 10,000 steps daily has been estimated to provide an economic surplus of approximately $105 per day—or nearly $38,000 per year—when factoring in healthcare savings and productivity gains.

Corporate return on wellness: Employers investing in wellness programs can see $3–6 in benefits for every $1 spent, through lowered healthcare costs and decreased absenteeism.

These ripple effects benefit not only employees’ wallets but also employers’ bottom lines, and that could eventually translate to lower insurance premiums and better wages.

3. Low-Cost Ways to Stay Active

The beauty of exercise is that it doesn’t require a big budget. Here are affordable strategies:

Walking & cycling: Walking briskly or cycling is free (or very low-cost) and offers substantial health benefits.

Home fitness routines: There are countless free online workouts (e.g., bodyweight exercises, yoga, HIIT) that require no gear.

Low-cost equipment: For minimal investment, jump ropes, resistance bands, or yoga mats are effective and often cost under $30.

Minimal-equipment setups: A modest home gym with a few dumbbells and a mat can be built for under $200—still far less than many gym memberships.

4. Gym Membership vs. Home Gym: Crunching the Numbers

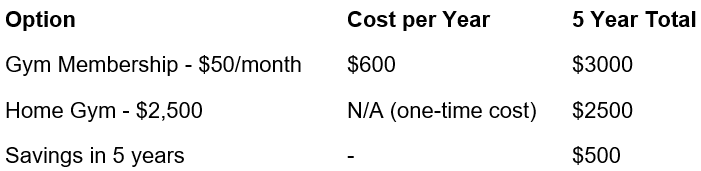

If you prefer structured workouts or gym amenities, you’ll need to weigh lifetime costs:

Gym membership: A typical membership costs around $30–$100/month, which adds up to $360–$1,200/year.

Home gym setup: You can start with basic gear for $500, or invest up to $2,500+ for a more complete setup. Over time, you'll likely break even. For example, a $2,500 setup pays for itself in roughly five years if you’d otherwise pay $50/month.

Hidden costs of gym memberships: Don’t forget commuting time, fuel, and potential cancellation fees.

Simple ROI Example:

5. Everyday Movement Adds Up

You don’t have to join a gym or invest in equipment to reap financial benefits:

Take the stairs instead of elevators or escalators.

Park farther from your destination and walk.

Use a standing desk or take regular breaks to stretch.

Walk or cycle for short trips instead of driving.

Even small additions to your daily routine can compound into major savings by improving your long‑term health and cutting future medical bills.

Conclusion: Active Lifestyle = Financial Wins

Live healthier + longer: Exercise reduces the risk of chronic illness, cutting down on medications and doctor visits.

Boost your income: Stay productive, miss fewer days, and possibly qualify for lower insurance premiums.

Spend less but gain more: Affordable fitness strategies like walking, home workouts, and basic equipment yield strong health returns at minimal cost.

Invest in yourself: Whether it's a $30 yoga mat or a $2,500 home gym, you’re investing in lower future expenses and improved quality of life.

Takeaway Tips

Do the math: Estimate how much you're spending on healthcare and exercise. Even $500/year saved adds up to $2,500 over 5 years.

Start simple: Begin with walking or free workouts—no investment needed.

Scale as needed: Want variety or structure? Compare a $50/month gym vs. a $500 home setup to see what fits your habits.

Make movement a habit: Small choices—taking stairs, parking farther—build into long-term savings and well-being.

By blending fitness with frugality, you're not only investing in your health, but also trimming your financial future. Stay active, stay well, and watch your bank balance benefit along the way!

References:

https://www.strongerlifehq.com/blog/how-exercise-saves-you-money

https://www.thesun.co.uk/health/35875942/walk-slightly-faster-improve-health-old-age-study/

https://www.thesun.co.uk/shopping/27381865/how-to-save-on-your-summer-body/

https://www.ironmaster.com/blog/create-your-home-gym-guide-convenience-cost-flexibility/